In our last article, we showed how we could use Morningstar’s investment model to measure the risk versus return on a real estate investment. Today, we will show you how our investment model can be used to balance your real estate portfolio.

Why a Balanced Real Estate Portfolio is Important

Perhaps you have heard advisors say that an investor needs to balance their portfolio. An investor may think that they mean that they should diversify – some apartments, some commercial storefronts, some single-family, etc. While to a degree that is good, it is more important is to balance your risk.

Each real estate investment property will provide it’s investor a return. The return, however, is not 100 percent guaranteed. Some degree of risk is involved. What if the tenant refuses to pay? What if the tenant trashes the building? What if it will cost a year’s NOI to replace the roof? What if interest rates rise on my mortgage? All of these factors, and more, represent the investor’s risk. The higher the risk, the higher the investor’s required return.

While an investor wants to reap the highest return on their money as possible, holding only high-risk properties is a risky business. An investor should make sure that their real estate portfolio has enough stable income properties to offset the risk created by their high return investments.

How to Measure Risk in a Real Estate Portfolio

Perhaps the easiest way to measure the risk in a real estate portfolio is by comparing capitalization rates. The capitalization rate is calculated by dividing the NOI into the purchase price. Hence, if you have a $550,000 building that generates $55,000 of net operating income, the capitalization rate is 10 percent. Consider these two investments:

You purchased a gas station for $550,000 that has a 10-year absolute net lease meaning that the tenant covers all of the expenses including taxes, insurance, and structural repairs. The capitalization rate is 4 percent.

You also purchased a 15 unit apartment building for $550,000 that is in fair to average condition and is located is a not so safe neighborhood. The vacancy rate is high and the building needs a considerable number of repairs. The capitalization rate is 10 percent.

Which property is a better investment? It depends on your risk tolerance. The gas station will require no effort on your part and there are no expenses except for maybe a mortgage payment. This is why the cap rate is so low. The apartment building, on the other hand, will require a ton of hands-on attention, but the gross income is high in relation to the purchase price and that risk versus return creates a higher capitalization rate. So, which is better, well how much risk are you ready to handle?

Help to Measure Real Estate Portfolio Risk

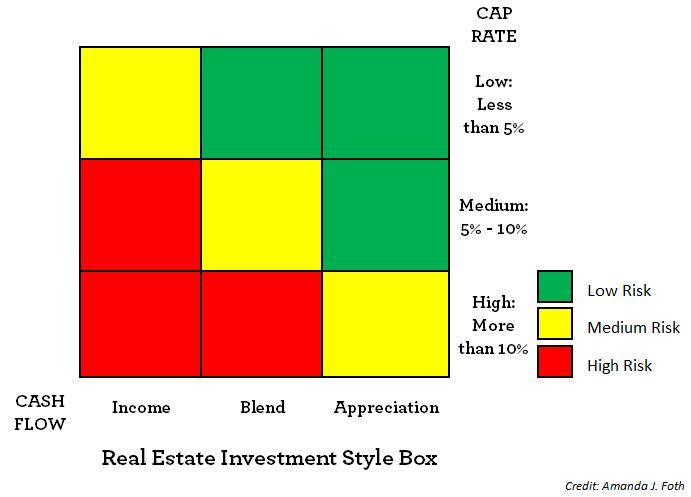

In our last article, we created a real estate investment model as a way to measure the risk versus return on individual investments.

A high-risk investment would be a property that has a cash flow entirely dependent on income with no anticipated price appreciation (think rundown apartment buildings in the slums). These properties will have a high capitalization rate. A very low-risk investment would be a property that has some income cash flow but offers a very good market appreciation rate (think absolute net lease from a AAA tenant in a very good location). These properties will offer their investors a lower than average capitalization rate.

Most investment properties are going to come somewhere in the middle. They will offer a capitalization rate between 5 and 10 percent. An investor will want to measure the strengths and weaknesses of the income stream. Is it heavily weighted on income or value appreciation or is it somewhere in the middle? Real estate investment portfolios should contain a balance of income and appreciation properties.

In our next article in this series, we will discuss how to set up a portfolio that can support your retirement.