Rental Owner-Investor Tips, News, & Guides

Our Extensive Landlord-Investor Property Management Guides Have Helped Thousands Just Like You – Get Yours Today

DIY Property Management, How-To, & Market Articles

Pilot Rental Property Showing Program – ShowMojo for Charlotte/Rock Hill Rental Homes

Pilot Rental Property Showing Scheduler Program – ShowMojo for Charlotte/Rock Hill Rental Homes We’re excited to announce the launch of a pilot program utilizing the…

Navigating Skyrocketing Homeowners Insurance Rates Due to Climate Change and Inflation

Navigating Skyrocketing Homeowners Insurance Rates Due to Climate Change and Inflation If you’re a homeowner landlord, you’ve likely noticed your homeowners insurance premiums increasing substantially…

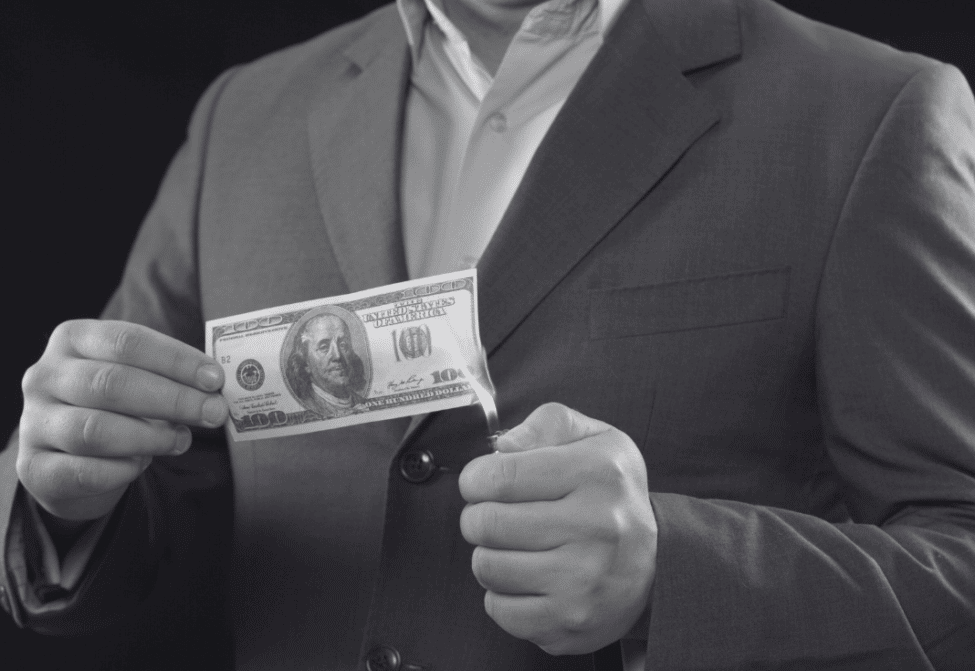

The Poor Property Manager’s Sleight of Hand: Focusing on Cost to Distract From Poor Performance

The Weak Property Management Company’s Sleight of Hand: Focusing on Cost to Distract From Poor Performance In the world of property management, there is one…

Expertise.com and PropertyManagement.com: Biased Results with No Rigor

Expertise.com and PropertyManagement.com, AllPropertyManagement.com: Paid or Outdated Property Management Company Data That Don’t Help Property Managers In the early days of the internet, directories like…

Press Release WILMINGTON, NC (February 27, 2024): Inc Magazine Recognizes MoveZen Property Management as the NO. 119 Leading Company on the Inc 5000 Regionals List, Mid-Atlantic Region

Press Release WILMINGTON, NC (February 27, 2024): Inc Magazine Recognizes MoveZen Property Management as the NO. 119 Leading Company on the Inc 5000 Regionals List,…

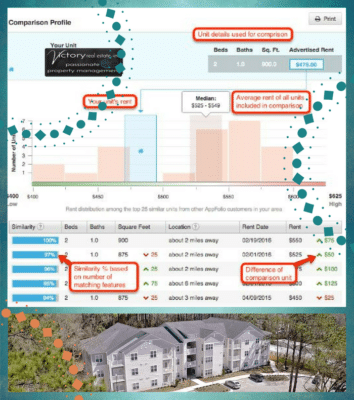

Rental Investors Must Properly Prioritize How They View the Costs of Being a Landlord. Here’s How

Rental Investors Must Properly Prioritize How They View the Costs of Being a Landlord. Here’s How Did You Know? That the cost of property management…

How Can Teamwork Deliver $100K+ to Struggling Rental Investors? Our December to Remember

How Can Teamwork Deliver $100K+ to Struggling Rental Investors? Our December to Remember 2023 was a generally slow year for the rental market. There were…

Why MoveZen is Pivoting from a Salary Employment Model to a Commission-Based Brokerage Model

We Think a Phenomenal Property Management Brokerage System is the Perfect Solution for Concerned Sales Brokers Before COVID struck our company ran an exceptionally tight…

Paws4people® Foundation – Assistance Animal Training

MoveZen Charity Event and Team Building – Wilmington, NC Our Wilmington team, and COO Alisha Robbins had the pleasure of working with paws4people at a…

Fast Company Most Innovative Companies: MoveZen Submission

MoveZen Property Management, the Single-Family Rental Market’s Leading Innovator Using innovative strategies and amazing customer service MoveZen consistently brings rental owners and renters together for…

Should You Use Your Home as an Airbnb Rental?

With the rise in popularity of short-term rental platforms like Airbnb, many homeowners are considering the possibility of renting out their homes to generate extra…

The Rise of Build-to-Rent Communities

With the increasing popularity of renting and the challenges of homeownership, a new trend has emerged in the real estate market – build-to-rent (BTR) communities…

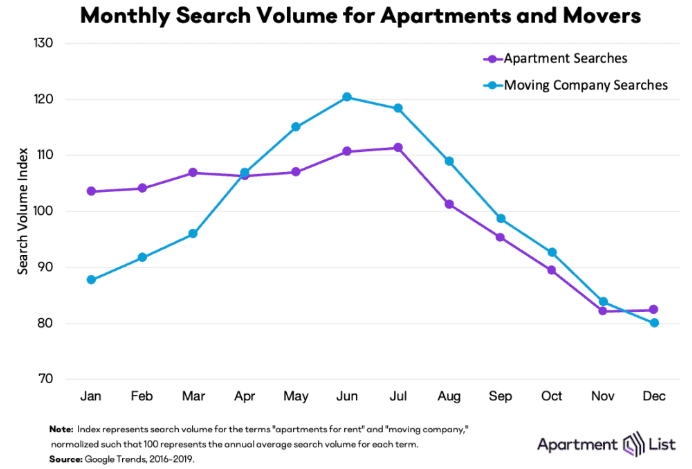

Rental Property Vacancy: Understanding the True Cost

As a landlord, one of the biggest challenges you face is rental property vacancy. When your property sits unoccupied, it not only results in a…

All About Zillow Rental Manager: A Transformative Solution for Landlords and Residents

Zillow Rental Manager Unlocks a Ton of Value for Both Potential Renters and Rental Investors Introduction A Few Zillow Rentals FAQ Questions We Often Get…