Fall 2023-2024 Annual Update to MoveZen Customers & Supporters. A Modern Company

Introduction

Thank you for your interest in our 2023 update. We’re a bit behind schedule since our last update last June, but that allowed us time to observe and absorb the unprecedented changes we’re seeing in the industry, and our local markets

When an industry drastically changes it would be an obvious mistake if the company didn’t change as well. We embarked on an evolutionary process in 2021, and the toughest and riskiest phase is largely complete. We are now a modern company, fundamentally designed to thrive in a post-COVID rental housing world. We are dynamic and responsive but focused. Above all, we’ve laid the groundwork to separate and simplify staff knowledge and duties significantly by adding two new divisions, operations, and technical support. This makes all aspects of the staffing process run more smoothly, and that quickly translates into happy customers. This is the foundation we’ve been driving to all these years, and it has arrived. We’ve performed well until now, but we are poised to deliver something special soon. At a time when skilled management is more important than ever, our goal from here is to deliver you compounding benefits of all types.

As for the rental market, at this point, we feel we see the outline of the runway for the next couple of years. It doesn’t appear to be great news for many rental investors, but as we noted two years ago, housing is likely to be the brightest spot in the economy despite the challenges.

We’ve had a saying around our company for the past 2 years. Strategies that were marginal in 2019, are almost guaranteed to lose in 2024. Due to easy money FED policy, a lot of people and companies were running marginal strategies in 2019.

” Free money can actually undermine growth by making an economy less efficient. The more money costs, the more disciplined its allocation. If it’s costless to borrow, money flows into all sorts of unproductive uses. It flows into rampant speculation characterized by the crypto and meme stock crazes. It flows into zombie companies from indiscriminate investors seeking any decent yield. It harms competition by feeding industry concentrations.”

https://www.ft.com/content/163db4c6-303d-4a52-9275-66359e4515e2

The biggest issue is that we’ve seen a shockingly high increase in maintenance costs across the board, and now homeowners can’t count on refinancing in 2 years to recoup the money they are laying out to keep their investments in shape. Being a successful investor now requires discipline and patience in almost all situations

A Relentless March Toward Quality Owners, Properties, and Property Management Staff

Our business is tough. Our average owner has been with us for almost 5 years and often including a hurricane, financial crisis, or pandemic. In many cases, the resident we placed years ago is a very different person from the one we’re dealing with today. Time marches on and people change, especially these days. For us to deliver highly consistent results to thousands of owners over our average 5-year relationship, we simply must always remain disciplined. More importantly, we must have you, our partner, confident and understanding of the strategy.

You will also recall from our updates since 2021, that we’ve been on a consistent march toward quality across the board. Quality properties, quality condition, quality staff, quality results, and all else need to be relentlessly trimmed these days. For that reason, we’ve voluntarily parted ways with nearly 25% of our customers since the start of 2022, and the standards for acceptance into our program are dramatically higher than they already were. Our growth has slowed dramatically because when quality is applied across the board these days, it’s difficult to find candidates. That’s one of the primary reasons discipline is important in high-interest-rate environments.

We’ve also parted ways with some staff. As with rental strategies, a lot of relationships from 2019 are no longer viable. We could see the problems ahead in 2021 and invested heavily in staff wellness. Not to say we got away from that focus, but we did find that often we were forced to choose between a pleasant environment or an atmosphere that demands excellence on behalf of our customers. We’ve been clear all along how that would go. We have made some mistakes, and we will make some more in this environment, but few companies are working as diligently as we are to get back to pre-2019 levels of consistent performance when we very rarely had to evict a resident. Or had turnovers drag out, missed inspection items, etc. We are very aware that we are making these mistakes. The challenges in housing and small business are both well documented. Our belief has always been that if we’re struggling most others must be completely unraveling, and there’s evidence of major challenges in every industry, with housing being a primary culprit. Not to mention we all experience it every week when trying to get our personal lives handled. People just do not run as well as they used to. We are innovating a ton of new strategies outlined below to get pre-COVID results despite a very different climate, and we are making major headway. Given the challenges over the past 3 years we’re outperforming the industry by a very wide margin overall, but that is not an acceptable bar for us.

We encouraged our owners to join us on this march to quality as well. We felt it was a crucial preparation for today. The attitude that a renter will accept a home in questionable condition for a slightly lower rate is true. What is also true is that especially these days the resident, at some point in the next 5 years has very high odds of stopping payment, forcing an eviction, and leaving a major turnover bill when vacating. That will wipe out most of the past 5 years of income for many owners.

In the minds of renters these days there’s an implied quid pro quo when they move into a home with unaddressed repair needs. The owner doesn’t care, so I don’t either. There’s little we can do as managers to gauge if that will happen or to deal with it.

Adapt to Thrive in A High Interest Rate Rental Market

Our pivot from a decade of fast portfolio growth to almost none in our older larger markets has been painful and swift, but we saw the challenges, positioned ourselves well in advance, executed along the way, and we are on strong footing to move into the new paradigm of rental investment, management, and housing public relations. Rental investors will need to come to similar terms as soon as possible.

We cannot stress enough how much the landscape has changed for:

Rental Investment: We’ve outlined for years that costs have exploded along with repair needs as more people spend more time in the home. Challenges and fraud for rental owners have exploded, and financing is never cheap anymore which drives up the cost of every aspect of housing.

Management: As noted fraud has increased 10X in the past 5 years, it’s a well-documented issue in the rental industry. Our biggest challenge this year came in the form of residents who had been paying rent for some time on a credit card. When rates exploded higher and standards tightened, real cash quickly became necessary and this is by far the most common problem pattern we’ve had this year.

Maintenance and vendors are much better than 2022 but still the second toughest year we’ve ever had. The same can be said for staffing. While residents these days are notoriously difficult, we are handling that problem very well with small investments. In 2023 nearly half of the rental competition is stock from Silicon Valley or Wall Street, listing updated homes in near perfect condition (not the same thing) with professional photos and 3D scans as standard procedure. The competition, technology, trends, listing pace, all move and change so fast it’s difficult for our high-tech highly experienced organization to keep up. For the inexperienced in particular, it’s a snowy field filled with landmines.

Contractors, especially certain kinds are getting very rare and hard to find.

This was never a high margin business, now exploding rates are eating away at meager resources from all sides.

Many residents are hitting an inflection point with their credit card debt, and those situations have to be carefully managed to avoid major problems.

Evictions are dramatically tougher (often for fraud), and take much longer as well.

Despite the fraud and credit problems across the industry, it is still very rare for us to go to court for an eviction, in large part due to our overall strategy with residents.

We’re already seeing highly effective fraud using old fashioned systems. The most terrifying aspect of our industry is how we’ll manage when AI can spin up a video with speech of a real person, answering typed prompts in real time. Or apply their actual image to multiple identities so that even a face to face meeting doesn’t solve the problem.

That names just a few of the challenges we face these days.

Public Relations: A social media post that mentions that someone might “choose” to rent is immediately met with scorn, and that’s one of the better situations. It can be a challenge being vilified for issues you obviously have no control over. For simply doing your job in a fair way. In fact, while building a stellar reputation with the residents who actually do business with us. What we do control, our company policies, are obviously golden rule founded. Our reputation proves it, so it’s unfair. We also understand it’s part of the territory now, but being in the negative spotlight all of the time is a challenge for both managers and landlords.

Market Forecast:

Last June we predicted that for the homes we manage, we’d likely see a 10% decline year over year. This is for the well above average homes that we manage, in the strong markets we operate in. When you read regional and national numbers they move in much smaller percentages, because it’s spread across a much more diverse location, rates, and property types, mainly apartments. A 2% decline nationally for example is a dramatically slower market for most mid-to-high-income rentals. Higher-end homes are more volatile on a percentage basis, and these renters tend to ebb and flow more than lower-income.

We did not see the 10% decline in June as the market slowed, and rental rates held steady across the board in our markets until recently. There’s always a marked lull in the rental market after the summer rush, and that typically means a 5% decline (average decline for our properties) leading into October, where the market tends to start trending up into December. That has been pretty standard for years.

What we are seeing this year moving into October is that almost all rental rates are down at least 10%, and many are down 20%. Days on market have increased dramatically too, because our account managers are having a very hard time conveying how swift and thorough the market slowdown has been. With the conviction needed to get sizeable price reductions. This is an issue we are addressing with our account management staff now, but applying pressure to their owners is not their strong suit we’ve come to learn.

These are decent homes, in strong metros, and they are renting for dramatically less than a year ago. Of course, 20% of $2500 is $500 a month less. That is quite common in neighborhoods with 2500 sqft homes on smaller lots across all of our markets. A type of home we mentioned is tough to manage in 2021 and outlined several reasons why. Not only have rents fallen, turnover costs on these homes can be extremely high due to the size-to-rent ratio. A simple cleaning is costly on a home this size these days. We outline in a previous update why these homes in particular were already risky rentals due to the low rent-to-cost ratio. A metric that will probably be important in measuring which investments will do well in the future.

Another important point is that once declined to 2,000, a 10% increase only gets you back to $2200 so we likely just had at least one market-wide repricing of rents.

We are unlikely to see a serious decrease in costs and challenges getting repairs done at any time in the next decade due to obvious labor shortages and a lack of talent in the pipeline. We need a TikTok craze that spurs youth to become housing contractors fast.

Nuance has entered the market again as well. Two homes similar to the above example, in the same neighborhood might vary by $300 a month because one has a privacy fence, or is in good vs questionable condition.

Or there’s a good chance the landlord/manager took the $300 higher offer despite the fact the resident applying only had one credit item on their 5-year-old report (almost guaranteed fraud).

Meet The Prized MoveZen Team

That said, many neighborhoods are falling into questionable condition as the high cost of capital bites from all sides. A great home in a very questionable neighborhood will struggle. A below-average home in a questionable neighborhood probably doesn’t make a lot of financial sense for the next few years at least. At a minimum, it requires aggressive and questionable strategies to thrive. Discipline and a competitive price are the only antidote that increases the odds of success, but those approvals are hard to come by.

Update and repair decisions matter a lot now. Unfortunately, the payback and ROI analysis required to make them well is a skill that hasn’t been needed much until lately and is in short supply. The joys of delayed gratification aren’t trending these days either.

More importantly is that a large swath of rental investors have not begun to accept how much tougher the landscape is likely to be from here, and in general it’s reflected in their reduction, update, and repair strategies, to their detriment.

Where Do We Go From Here?

Unfortunately, we continue to predict a fair amount of pain ahead. We’ve noted for years that interest rates are the metric to watch, bottom line. If rates stay flat or especially continue higher (our estimation), then the next 12 months are likely to see another 10-15% decline in rental rates (our markets and homes).

In addition, the FED has clearly targeted housing. It’s mentioned quite a bit in every meeting and in press quotes. Just on July 5th one president stated that they have been very surprised by how resilient the housing market is. That’s due to low inventory which will not improve anytime soon. That boxes them into a degree as housing affordability is likely to be a major political topic and driver of inflation for the rest of our lives. They may be forced to raise rates quite a bit more. Rental investors must be prepared for the FED to get their way, and force a decline in rental rates. As the adage goes, don’t fight the FED.

“”The bigger picture is that the trend is still quite encouraging, but the fight continues,” said Olu Sonola, head of U.S. regional economics for Fitch Ratings. “The uptick in housing inflation this month was the key surprise. Housing inflation will need to decline sharply over the coming months for us to see inflation near 2%.”

https://www.reuters.com/markets/us/housing-remains-puzzle-feds-inflation-fight-2023-10-12/

They will likely drive prices into the ground, only to try and boost them back up. A great opportunity for Wall Street to snap up more distressed inventory from mom-and-pop investors.

Rattled by rising interest rates and a stalling economy, even the most voracious Wall Street investors have grown wary of sinking money into the nation’s wobbly housing market.

For now, they’re proceeding with caution. But their longer-term view is as buoyant as ever.

https://www.businessinsider.com/corporate-landlords-ready-110-billion-to-pounce-on-homes-2022-12

By the end of next year or possibly by the spring of 2025 we expect most of the COVID excesses will have worn off, inventory issues will be worse than ever, and we’ll likely return to a more promising rental investment market with a consistent upward trend. That isn’t to say it’ll be like 2018 though, as very easy money is probably a thing of the past. Nimble, flexible, unbiased, and unemotional investors that have a laser focus on Net Annual Income (NAI) will likely dominate the alternative, continue to corner a large portion of the rental housing inventory, and reap dramatically higher benefits than the ones who run marginal strategies, regardless of their success in 2019.

So the final market forecast in summary is that we’re likely to see one very tough year ahead, with pain coming from all sides, and after that, it should be a more reasonable but promising market for smaller rental investors. At least in our metro areas and states, and for investors who follow old-fashioned sound advice.

One important point regarding the year ahead with our company. MoveZen (formerly Victory) has always taken a long-term view, except for a 10-month period recently where prices were rising at an alarming rate, and we have always opted for long-term leases. Our agreements auto-renew for a year if we opt to let them, and position heavily against month to month, or even shorter terms unless they coincide with seasonal strength.

There’s much more to our strategy than this though. As we outline below we have increased our resident satisfaction to the heights of our industry. While common in multi-family, resident satisfaction is an afterthought in our industry, single-family rentals. We see first-hand the power of our reputation. We hear every week that a resident chose our property over the one next door because we had a dramatically better reputation than anyone else listing in the neighborhood. That translates into real money for our owners, and with small costs we continue to get better and better at efficiently handling.

Here’s a glimpse into the multi-family way of thinking. Why would experienced professionals invest so heavily in this model? Despite sounding charitable, that’s rarely the reason, but it is a win-win and that’s almost as good.

“The Life Properties’ core principles for property management revolve around providing an elevated living experience for residents, rooted in a people-first approach and sustainable practices. We focus on delivering tailored capital improvements, implementing sustainable programming efforts, and prioritizing community engagement activities for resident enrichment.”

Even our name change was a message to the world, housing is tough, we get it, and we’re on a mission to fix that.

The fact that our residents feel special with MoveZen, guarantees they will think very long and hard before they opt to jump back into the rental market, slow or not. In fact, it’s likely the best results of this approach will be felt during the crucial upcoming 18 months. It’s imperative to keep that in mind as our staff reaches out for your support on small gestures that protect that powerful moat we are building around our castle. A castle filled with happy owners residents, and managers. This is our strategy. We’re running a Marriott-style strategy, not Motel 6, and we need our owners onboard. We feel it’s the obvious winner, and we’re confident the future will bear that out clearly.

We cover the juxtaposition of those two strategies extensively in last year’s annual update.

Twice in my career, I’ve heard a large rental investor use the term “mass exodus”. One was in 2008, and one was in 2023

For an owner running an aggressive management strategy of shorter leases, auto increases, and other tedious rules because that allowed for more frequent rate increases, faster placement, or easier pre-evictions, times like these can expose why that strategy isn’t nearly the long-term winner it appears to be in great times. Ironically many were burned in 2020 due to being locked in with bad residents, and that painted their decisions leading into a likely rental recession. Luckily by far most of our owners will dodge serious problems during both events.

We structure everything about our lease process to ensure most of our owners would be able to largely ride out one or two tough years with very little stress or financial strain. For anyone who does have to deal with a poorly timed move-out, we did our best and will be well-positioned, and no manager is better at working out of a bind than we are.

Our reputation has been a sustaining force that has kept us running well through a very tough few years, but it is because we prepared for rising rates and the consequences that always follow them well in advance that we are on sound footing today. Our company grew by just under 100% from 2019 to 2023 and has since slowed to a crawl. We were hiring as fast as we could and struggling to fill positions until suddenly we weren’t. It would have been easy to get caught dramatically overextended and in denial about the extent of change in the industry, refuse to respond and dig in, but we stayed focused on our plan, and as rates rose we enacted more and more aggressive cost, expectation, and growth cutting measures to ensure we were well positioned when the music stops. That’s a good strategy for landlords as well. Prepare for potentially higher rates, meaning lower rents and higher carry costs. Properly account for vacancy (a much bigger issue in a slower market), by focusing on your net annual income, and keep a large cash reserve that grows with interest rates (CDs are very attractive now). Above all, stay focused on long-term quality and the discipline it requires, and you will fair well ahead if you’re on a good personal footing. If not, you should sell.

Basic economics state and this still applies in commercial real estate, that if the return on an investment (rental rates) declines for a long enough period it’ll lead the value to decline eventually(sales prices). This means sales values should fall if rental rates stay low or go lower. In commercial property management (apartments and business) there’s a literal equation for this process called the cap rate. There are a lot of leftover funds from the great money expansion, so it remains to be seen if that maxim will hold true this time around. With so many well-funded large institutions it’s possible to prop up the housing market until broader inflation is under control.

We feel all the articles that decry a return to affordability may be mistaken. There’s no law that rents have to be affordable within large cities, and in our view, they likely never will be again. Even in rural areas, it can be surprising what rents have risen to, but it’s a complicated process that includes a lot more than housing demand. Any decline is likely to be short-lived and far from comparable to the increases of 2020-2023. Skyrocketing repair costs combined with rampant effective fraud, dramatically less efficient government procedures, combined with higher taxes haven’t been properly priced into the market yet, and that affects all parties eventually.

Our estimation is that at some point in the next 5 years, it will become clear that the United States is in a perfect storm of labor shortage combined with housing shortage, and we are going to see major problems. For the rentals and owners in place at that time, it should be a very strong market provided rents aren’t capped, etc.

We’re not advocating this outcome, it’s terrible for our company to see mom-and-pop investors drying up along with rentable housing inventory, and we’re constantly looking for ways to address both of those issues.

Rental Market Trends

Two new trends we’d like to detail are:

Fraud

There’s been at least a 5X increase in fraud in the rental industry since 2021. However spotting fraud used to be easy, now they bring ID’s with their actual photo that is actually from the state, despite being a person that doesn’t exist. They have matching computer-generated check stubs with companies that don’t directly verify employment, and somehow inexplicably a 3-5-year-old credit report with a single item, maybe two with perfect payment history. These reports often have high 600 and even 700+ scores. Imagine how challenging that is for a company that processes several of these each week. At this point, we simply can no longer accept those credit situations without extensive and onerous verification requirements. That makes it harder to place a resident. One buffer we’ve employed is offered by our management software Appfolio, and that is bank login income verification. It’s an aggressive screening procedure and adds a fair amount of cost, but we have an across-the-board policy to approach those types of reports (and a few others) with extreme caution. The vast majority do not run the income verification. Not all are fraud, unfortunately, so we lose a lot of decent leads now due to that issue.

These reports all show similar hallmarks and now we’re good at spotting them, and we are proud to have navigated a period when half the credit reports we pulled appeared to be incomplete (common during COVID), and another period where a huge number were exceptional fraud attempts. We lose sleep wondering what the next scam will be, how exceptional will it be (AI-generated is particularly terrifying), and how soon will it be on our doorstep.

Resident Satisfaction

As we’ve noted, we are building a new model in the single-family industry. One where the benefits of reputation are dramatically larger than the costs they entail. We are already seeing clear results, and as noted we expect the majority of benefits in the coming years. After unprecedented upheaval in our industry, our company needed a guiding light to drive our staff to strive for greatness, and this method that has underpinned our culture from our founding couldn’t be a better option 15 years later. This is a win-win that if adopted across the country would dramatically benefit both landlords and residents. What better cause to fight for.

We aren’t just taking great care of residents. We’re innovating new ways to communicate so that they know when we’re taking care of them (far from given) so that we can get you onboard with our strategies.

We’re innovating new ways to absorb those costs efficiently. For example, we’re on the road substantially more these days as a result of our filter delivery program. It’s extremely costly but it also allowed us to restructure in a way where we absorbed most of that cost into our new operations division, a necessary response to the COVID changes in our industry. Now we are laying the groundwork with exceptional speed to offer discounted repairs to owners and even residents (great for the home as well), among dozens of other benefits that are so numerous we’ll outline them in a separate article soon.

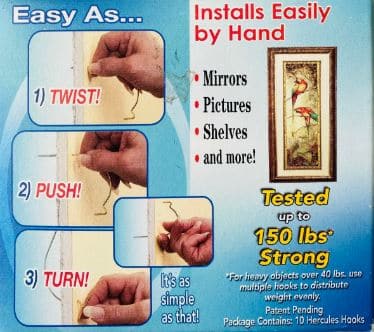

One particularly proud story comes from our new move-in packages. We deliver a classic MoveZen win-win with this idea. We bulk order large amounts of chair pads, command-type strips, bumpers, cable hiders, felt booties, and other extremely helpful move-in necessities that are extremely expensive when purchased in one-off amounts. Best of all we provide a handful of Hercules Hooks that in our opinion are one of the best inventions a landlord has ever enjoyed, but few know about. What you might note about this gift bag is that it’s filled with items that benefit both owner and resident dramatically, and we absorb the costs better as a result of buying in very large quantities. This is a metaphor for our model.

Another occurred as we were rolling out our operations division for the first time. We were training a new hire on our new home visit process but mostly ended up chatting amicably with the resident for a few minutes. More importantly, we changed her air filter which was 10 feet high on a landing. A simple step that took us minutes, benefited the owner greatly and obviously left the resident ecstatic.

It was a eureka moment. We walked in to inspect, and we walked out laughing with the world’s happiest resident. At that point, we realized, the home was in obviously phenomenal shape, as most of ours are. So what exactly should we be inspecting? Here’s what we came up with.

DO:

Look for dramatic wear and tear. Some materials degrade fast, and it’s very helpful for all to regularly document and possibly discuss it

Look for dramatic issues like pests and water damage. Both are almost immediately obvious, often before you enter (something we can assess on a filter delivery without bothering the resident).

Also a form of wear and tear, your main focus should be the exterior, water damage, rot, etc. We turn the interior over every two years on average, but we rarely do much with the exterior of a home. However, a siding and roof replacement can easily run fifty thousand dollars on the median home. We can’t let that sneak up on our owners.

Get a few representative photos that make it clear to the owner that the home is extremely well cared for. So far almost none have been unhappy with that approach.

Try to do one small 5-minute gesture for the resident especially if safety is involved. Height is the most common need.

Use simple good judgment as to how invasive a visit should be, and the answer is usually very little.

Provide extensive exterior photos, and enough general interior photos to leave no doubt for the owner what general condition the home is in.

DON’T:

Use the word inspection. It has a noticeably negative connotation. It’s forbidden now unless it’s a vacant, misused, or damaged home. We do “home visits” to connect with our residents and properties. This isn’t corporate speak, we are building a large following with this approach and blazing a resident satisfaction trail we feel has not existed before now. If it can make them a bit less likely to cringe or get defensive, and we apply that from A to Z, we see major results every time.

Walk into an obviously well-cared-for home, and walk through a pointless and invasive checklist.

Miss the opportunity to connect with your resident for 5 minutes after you just expended an hour to get there.

Penny pinch on a small gesture.

Obviously, in those rare instances the home isn’t well cared for we take a significantly different approach, but we chose to build a policy that focuses on the majority of our residents who are phenomenal.

Soon this will be standard procedure in all of our 2+ year-old locations, and we are looking forward to watching it develop.

Trend-wise it’s been a relatively standard year with most of the COVID habits lessening but still functioning for the most part, and these were covered extensively in:

Stark In the Trenches: COVID-19 Housing Trends

Operations

We outlined the operations division idea in 2021 after we saw maintenance reports of literally every kind skyrocket. Prior to that maintenance was a minor part of the business, since then it’s been one of the most significant. That’s likely to continue due to severe and growing labor shortages.

It became very obvious that if we wanted to deliver consistent long-term results (a major goal), we had to control this crucial process to the maximum amount possible.

Subsequent years have only solidified that estimation, and now less than 2 years later we’re poised to formally launch a highly innovative operations division this spring. The number one purpose is to advance our ability to produce happy residents and owners. We will have to bill for many of these services, but the real goal is to deliver a service that our competitors simply cannot compete with, and use that edge to dramatically expand. That model revolves around your success. We don’t need this to be a major profit center for it to be a significant benefit to our company, customers, and goals.

That means we can offer this service at a significant value to both owners and residents. That value comes in many forms, some direct, some indirect but substantial. Operations will perform both no-charge duties (duties outlined in the management agreement such as home visits) as well as billed services like upgrading smoke detectors to 10-year lithium versions. The points below typically benefit both owners and residents in some fashion and address billed and no-charge services.

Increased Quality for Owners

This is the most important free benefit. In the past, our account managers often had to run out to a home and sweep up bugs before a move in, run several errands along the way because in our low-margin business, we simply can’t be successful if we don’t batch field work, then return to the office and try to clear important voicemail and tasks to close out the day. Often while handling an emergency somewhere in the mix. They had very little control over their field schedules, and that led to limited control over their office schedules.

It also required us to find classic “hybrid” managers that were pretty good at everything, and willing to get their hands dirty before turning on a dime and delivering exceptional customer service and concern.

Now our operations division handles the vast majority of field work, especially time-sensitive needs. That simple adjustment gives our entire account manager workforce in a given office dramatically more control over their schedule. They certainly do field work, though it’s mainly customer-focused. They also don’t have to batch as many tasks in a trip. They can time around traffic or their office workload.

Another benefit is office processing. In the past we had to train and rely on each account manager to follow relatively tedious procedures for setting up new accounts, cutting keys, assigning default standards, and much more. At a time when having people in the office was a major challenge, the day-to-day process of checking keys in and out, handling insurance notices, and all else couldn’t deliver the results we had to have.

Operations will now handle those tasks in a much more systematic, and better-trained way.

All this frees them up dramatically to sit locked in and focused at what we call their “battle stations” and process emergencies, customer needs, and whatever else this diverse job might throw at them with exceptional efficiency and care. Most importantly it puts them in front of their customers and vendor partners for the vast majority of the day. That is where they are most valuable, that is the most important skill in our company by far, and now they are highly focused on it.

Another major aspect of this separation and simplification of duties (a powerful concept unto itself) is that we can move away from hiring hybrid account managers. We’ve long known the person willing to really dig in and get the field work done phenomenally, was rarely also going to be the one able to communicate tough concepts to customers that get them happily onboard with the best solution we can offer based on our decades of experience. Now we can focus specifically on those who are the best of the best at delivering happy customers day after day, year after year.

Operations will also deliver extensive training and insights to our account managers, that improve their ability to collaborate as a team on tougher issues.

This combination has provided a potent new tool for our company to deliver consistent, long-term results of unmatched quality.

Cost-Efficiency

As a result of having a formal set of staff in the field most of the day, batching tasks to a large degree, and receiving exceptional and targeted training, we can trim the cost of fieldwork in particular to a dramatic degree. This freed up resources we could reinvest into new ideas and innovations operations could pursue, but most importantly it is driving costs down dramatically for our owners.

We know rentals very well, so we know where the inefficiencies in repairs and operations tend to hide. We are targeting our services specifically to address the most important needs rental investors tend to have, and contractors tend to struggle to deliver. The best example is any very small job. Since we’ll have extensive staff all over the city each week, handling a combination of company duties as well as billed services, it’s significantly easier for us to tighten a faucet, replace a defective smoke detector, and other small jobs that almost always cost well over $100 for our landlords. In our upcoming presentation, you’ll hear much more about our efficiencies, and how their pursuit will unlock major value for customers, but in the above example, we’d charge no more than $59 for labor, when $95 would be almost impossible to find in most markets.

We’re also working to roll out mostly flat fee pricing on the most common issues. This will eliminate the need for single job quotes, which of course dramatically speeds up the process. Most importantly it simplifies the process, removes friction, and gives owners confidence that they’re getting a fair service for a great price. It also delivers much-desired repairs to the resident more quickly.

Another goal we’ll outline in the upcoming presentation is all the benefits this approach can add to our resident satisfaction drive. One of the biggest challenges for renters is finding trustworthy vendors at a good value for that once every 2-3-year move. Otherwise, they’re rarely needed. Whereas a homeowner is constantly listening out with super-man like hearing for a great contractor reference, renters don’t. That tough challenge usually falls to the manager / landlord to handle instead. It also often leaves residents dealing with small easy-to-fix issues that degrade their desire to stay, for long periods. If we can offer them a great value on repairs it will improve their quality of life, and obviously improve the upkeep of the home as well.

Inspections

Many of you have likely already noticed an exponential increase in the quality of our inspections. Appfolio, our software doesn’t present them well but should improve. The presentation of the information needs work (not an operations strength) but the underlying care we’re putting into the actual inspection of the home at initial onboard, and after every move-out has transformed a lot of our management approach already, and presumably increased your happiness to a large degree as well.

Safety

The final and most important benefit is our renewed focus on safety and habitability. Along with increased importance to the national economy and social structure, housing safety is far more important for managers and landlords than it once was. It is simply not acceptable to expect residents to keep themselves safe based on the bare minimum required by law. For a 1 bedroom home built before 1999, a single smoke detector would be legally sufficient in NC. That means one malfunction or one cooking mishap could result in the only safety device being out of commission for weeks. As a result of our increased resources, we are taking a more active role in efficiently providing homes that are much safer than the basic laws might require. This positions us as doing the right thing for our community, and our people, as well as instilling the culture we need from our staff. Protecting you from the most significant risks of being a rental investor.

Both resident and staff safety are a major priority for operations, and they will undergo specialized training and goal setting to ensure it’s achieved.

Operations also delivers you and our leadership team a second opinion at opportune times and expands perspective in every way.

A property management operations division is not novel, however as we do, we are going to innovate and deliver unique win-win results that lead the industry. Largely what we’ve outlined above is a natural evolution as an office grows large enough to sustain such heavy capital investment. Still, we will also be designing another industry-leading innovative division that scales across distance and many locations, and that is novel. In the coming weeks, we’ll outline a technical presentation on what the future of operations holds, but the story of highly effective home visits provides an excellent glimpse into those goals.

Operations have been functioning for most of the year in several locations, but we haven’t done much billed work yet. They also serve a crucial purpose with inspections, home visits, marketing, keys, boxes, etc, and that was our primary focus first. We wanted to learn and craft the staff and customer communications necessary to ensure things go smoothly before heavy billing. We expect to have a fully functioning operations dept in every NC location by next summer, and that will be just the start of the many benefits you’ll enjoy with this addition.

To help smooth out the launch our focus will be on simpler jobs vendors tend to charge a lot for, that we can quote with a flat fee before we go to the property. Then if we arrive and that isn’t feasible, we’ll document what we found and send a report.

MoveZen Charitable Work

In 2023 MoveZen donated nearly $4,000 to mostly local charities in the cities where we operate.

In the past 6 years, we’ve donated over $30,000, and the majority of that amount was matched by a multi-national corporation.

We take great pains to donate when matching is involved and it’s relatively rare that we don’t. We research their credibility before donating. We also focus on mostly local charities that usually put their money to work on the street immediately. Here’s our donation list from the past 6 years.

Habitat for Humanity

SPCA of Wake County

Cape Fear Literacy Council

Beagle Rescue NC

Cape Fear Hospice

Red Cross

Salvation Army

Equine Rescue NC

Wikipedia

Life Rolls On

This is an important part of our company and staff satisfaction, and hopefully, it adds to yours as well.

Other Initiatives

In 2024 our company will be able to deliver stunning charts and graphs of all types showing current and historic data on market and company performance. Things like average rental rate increase/decline year over year, days on market, and average cost per sqft in a given zip code will be delivered regularly for your benefit, in easy-to-follow graphs and tables as part of a comprehensive industry market report. This is a small portion of a broad company initiative, and will also serve as a powerful management tool, as we’ll be able to visualize nearly all aspects of our staff’s performance, both great and marginal. We outline the significant technical hurdles here.

Support Team

We had so much success with our initial operations rollout that we began wondering what other separation and simplification of duties opportunity was there. We came up with an obvious answer. Rental management and life in general have gotten exponentially more technical on the heels of COVID, and we came to the conclusion that we probably shouldn’t expect our customer service rockstars to also be Windows, Office, automation, and technology wizards also. Taken even further, tedious tasks like resident notices, eviction filings, and project advancement aren’t terribly important to our account managers’ skill sets either.

We are removing those duties from their training and schedule so they can be replaced with customer focused, and advanced needs.

Right now we’re building a “Support Team” whose primary focus will be to deliver as much technical and technology help as possible, including creating custom automations that our account managers can use to deliver exceptional consistency and clarity.

Richmond VA, and SC

We have officially launched our brand in South Carolina and will be established in Virginia within a couple of months. We had intended to be here at this time last year, but as we noted in last year’s annual update, 2022 was by a large margin the hardest year in our 16-year history.

We realized relatively early on that we had two choices. Either protect our customers, brand, and reputation by putting all optional duties on complete hold or don’t. It was all hands on deck with the highest people in our company out cleaning homes and fixing punch list items for a large portion of the year. A lot of that stemmed from the fact that most vendors seemed incapable of taking a job past 80%. Another major motivation for the operations division, though the issue is substantially better now.

We’re back at our desks and moving quickly to start growing in Rock Hill SC, Greenville SC, and Richmond VA. We’re offering existing owners exceptional management pricing for these metros in early spring when we ramp up general hiring.

Automation and Artificial Intelligence

Interestingly while we’ve long been a cutting-edge single-family property management company, we’ve made a well-documented shift toward our customers, not bots. In fact, that’s a large part of the motivation.

Perhaps there may come a day, but people still desperately want to deal with people and we will fill that need for a very long time. That does though bring up a fascinating question you’ll one day see on a formal survey.

If an AI was legitimately as good as the best current property managers, would you prefer to deal with that?

We dealt with unprecedented inconsistency from the majority of our relationships in 2022, including our staff. That’s improved dramatically, but will likely be a global issue for a decade. Keep in mind our primary company focus is long-term consistent results, so it was a red alert type of problem. AI doesn’t sleep, doesn’t judge, is relatively bounded in its bias and likely to improve, doesn’t have personal problems, doesn’t have a bad day, etc. It’s an intriguing issue which also makes it pretty concerning.

That isn’t to say we don’t make great use of the amazing tools we have today. Our first significant brush with AI was actually in 2020 when we began to use an app called Frase to help us craft articles. In our opinion, they still won’t write useful unique business content at scale, but it can serve as a powerful tool and tutor to bounce ideas off of, edit, get research tips, etc.

Without a doubt, the quality and volume of our content doubled and brought results. We explore unique ideas and concepts with our media division that AI bots struggle with dramatically. It’s why our content performs much better than most of our competition who tend to all post the same basic checklists and decades-old concepts. Whether written by a person or a bot, it’s usually all the same. We explore today’s fascinating changes, and tomorrow’s risks and opportunities. AI has been a powerful tool to help us craft these unique ideas into phenomenal content actual people respond well to.

We also outline several highly technical strategies we’ve employed using ChatGPT (OpenAI) and Claude (Anthropic) in the link on innovation above.

We will continue to make heavy use of all the latest AI tools and strategies, but our goal is to keep that out of sight of our customers as much as possible. We’ll focus on the direct investments we’re making in your success.

Automation

One thing that benefits you and our company dramatically is automation. We’ve always been adept with it, but took the process to a stratospheric level in 2023. Yesterday our company performed over 300 automated tasks and we’ve only really been at the helm for 6 months. We intend to automate most of our non-customer functions.

Here’s one great example, Our management software Appfolio doesn’t allow us to split notifications by location. That left us with a frustrating and inefficient problem where most people in our company had to delete dozens of notices from their inbox each week that didn’t pertain to them, and the load grew with our company.

Now we process those notices to a Sharepoint list, filter them, and they are hosted on our Teams page for all to view by location, as needed. Now the entire company can turn off the notices and work from the list on a scheduled basis, meaning on our terms, not when the event occurs, and not with required company-wide organization and file cleanup.

We note in this letter that consistency has become both our biggest challenge and our biggest opportunity. Literally, nothing delivers the kind of consistency that 2023 automation does. This is one of the most exciting aspects of the next few years for our company. By automating crucial procedures, we can guarantee at a 98+% rate that certain things will occur how and when they are supposed to. When they don’t, we have an error log. For a company whose mantra is long-term consistent results, this is Mt Everest and must be conquered. Automation also further frees up our staff from tedious keyboard work, so they can focus fully on the customer.

Some MoveZen representatives will pursue a project that isn’t directly related to our company duties as the best public property management company in the area. Nothing will change with our mom-and-pop investor growth plans, we’re just looking to join our owners at scale in betting on the MoveZen management model.

Downtown Raleigh Townhome Development

Another development project some representatives are planning will be the construction of another build-to-rent community in downtown Raleigh NC. There is planning underway to build 4-7 luxury townhomes on a lot purchased in 2015. It’ll follow a common approach with 3 floors and a rooftop deck. Downtown Raleigh is one of the fastest growing places in the country and we’re looking forward to exclusively managing a flagship project just 6 blocks from the Red Hat Convention Center.

The following ideas are under consideration and would be 5+ years away if approved and funded.

Business-to-Business Management

Our company has always been willing to carve a new path, and we have learned a lot along the way. As with mom-and-pop investors, mom-and-pop property managers are also deeply under threat from the same basic players and causes. National companies funded with free FED money (squirreled away in years past hence sticky inflation) running a classic “business roll-up strategy”.

“If you acquire enough, you get economies of scale,” says Tim Clarke, PitchBook’s lead private equity analyst. “You just keep rolling rolling, rolling and before you know it you’ve got 10-20% of the market.” ‘They’re a Nuisance’

https://www.bnnbloomberg.ca/why-private-equity-is-chasing-plumbers-and-lumber-yards-1.1944607

But you rarely have a solid model after all of that, it’s a collection of ideals at best, with no focus or guiding light except to automate everything imaginable. In an echo to the famous Jeff Bezos quote we would say, “Your lack of a genuine human touch is our opportunity.”

Do you know who does have the human touch? Many mom-and-pop managers. What they struggle with is the technology in particular, but also consistency. This is a highly fragmented industry with few highly reliable providers, and it has gotten very hard to simply function, let alone thrive in the modern services business world dominated by hedge funds. We would like to address that.

In keeping with our idea of spreading benefits to housing across the nation, nothing offers more opportunity to solve problems than if we were to take the model that’s propelled us to strong long-term growth, package it up, and deliver it effectively to mom-and-pop property managers across the country. Because our business was built in a modular and scalable way from the beginning, we can easily apply these procedures anywhere in the country with a strong internet connection. In effect, we’ll deliver the technical results, so the local property managers can focus on their customers and enjoy the powerful benefits of being the area leader in customer satisfaction. Ultimately that’s the only way we can hope to outperform the unrelenting competition we face.

AirBnB Support & Logistics

We’re basically a local logistics company now, and we’re building innovative strategies. Since our founding, we’ve consistently received calls from AirBnB owners asking for help with logistics. Managing cleaning, emergency maintenance, lockouts, and all the things we largely do already, just not as urgently or frequently. With the addition of our operations division urgency, redundancy, and consistency will take center stage and that means adding AirBnB support and logistics to our growing list of homeowner services is a perfect match.

Owner Occupied Support

Taking that same idea one step further, we’ve also gotten relatively consistent requests from homeowners wanting us to handle the same duties we do for rentals, for them in their primary residence. Again, with operations, this is a natural progression and we’re looking forward to solving your personal home challenges soon as well.

We’re now a modern corporation, and we look forward to even greater consistency and improvement from here.

We want to thank everyone for their interest in our story, opinions, and forecasts. We’re incredibly grateful for the trust and confidence you’ve placed in our team. Your perspectives not only shape our performance but also fuel our ambition to innovate and lead in the property management industry.

Looking ahead, we’re committed to pushing boundaries and expanding our offerings, backed by cutting-edge technology and a relentless focus on customer satisfaction. The journey

towards our long-term goals is full of challenges, but with your continued support, we’re confident that the best is yet to come.

Thank you for being an integral part of our journey. Here’s to a year of growth, resilience, and impactful collaborations.

Updated 2024 Mission Statement

Constantly improve the rental housing management process to dramatically benefit both residents and rental owners through the magic of an amazing, innovative team.

Deliver the best resident satisfaction in the nation, combined with leading and constantly improving knowledge of the modern rental market.

Innovate at every level, all of the time. Above all, hunt for win-win opportunities that bring all parties together, then communicatie those benefits to achieve truly special results.

Spread our innovative customer-first approach as a national leader in the industry, to the benefit of all parties from residents and owners, to vendors and staff.

Maintain a culture that drives relentlessly toward excellence, a golden rule philosophy, and treating every home, lease, need, and cost, as if it’s our own.

Here’s to another solid, consistent year in 2024.

RE Hunter is the CEO of MoveZen Property Management. The leading model delivering unmatched customer service, resident retention, and consistent low headache results. MoveZen is transforming rental housing.

October 25, 2023